Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Buying a car in a state with a lower sales tax than your home state and potentially saving 5 6 or 7 percent of the cost is an attractive idea.

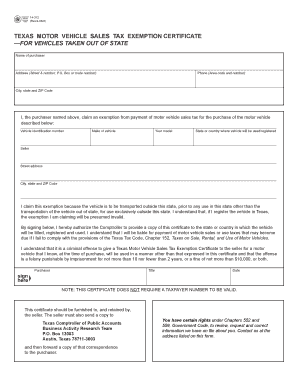

Fillable Online 14 312 Motor Vehicle Sales Tax Exemption

Fillable Online 14 312 Motor Vehicle Sales Tax Exemption

texas car sales tax out of state is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark texas car sales tax out of state using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Find your state below to determine the total cost of your new car including the.

Texas car sales tax out of state. Buying a car out of state and tax issues. How to collect sales tax in texas if you are based in texas. Collect sales tax at the tax rate where your business is located.

Calculating sales tax summary. What about local taxes. A car is a big purchase.

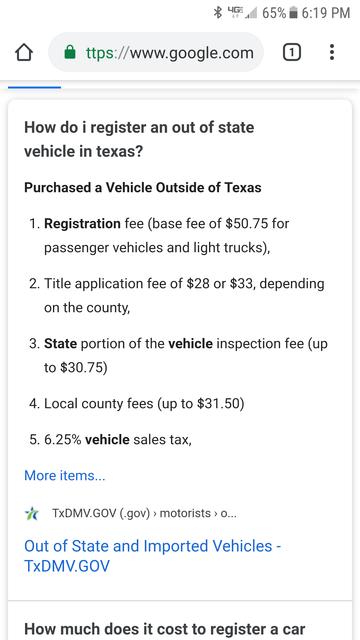

Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. Car tax is paid based on the state where the car is first registered so if you live in california and buy a car in oregon you will have to pay when you register the car back in your home state. So if you live in texas collecting sales tax is fairly easy.

So if you live in new york for example and buy a used vehicle in new hampshire a state without sales tax you still must pay new yorks sales tax. The sales tax rate you collect in texas depends on whether you are based in texas or out of state. If youre a remote seller in an origin based state you may still have to charge out of state sales tax based on the tax rate of the destination state but you may be able to simplify the calculation process by charging a flat use tax rate.

Many states have both a statewide sales tax and a local city or county sales taxes. United states vehicle sales tax varies by state and often by counties cities municipalities and localities within each state. In addition to state and local sales taxes there are a number of additional taxes and fees texas car buyers may encounter.

Who is responsible for this tax. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Contact the destination states department of revenue to determine what exactly youre supposed to charge.

These fees are separate from the sales tax and will likely be collected by the texas department of motor vehicles and not the texas comptroller of public accounts. Unfortunately you dont pay the auto sales tax of the state you buy the car in but the auto sales tax of the state you register it in. A person who purchases a motor vehicle in texas owes motor vehicle sales tax.

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent. A texas resident a person domiciled or doing business in texas or a new texas resident who brings into texas a motor vehicle that was purchased or leased out of state owes motor vehicle use tax the new resident tax or the gift tax. Unfortunately this doesnt work out well in practice.

If your out of state buyer places an order using their computer at home for delivery to another state you do not collect your local sales tax. Texas is an origin based sales tax state.

Chapter 7 Sales Taxes Vehicle Inventory Taxes And

Chapter 7 Sales Taxes Vehicle Inventory Taxes And

Registration Fees Penalties And Tax Rates Texas

Registration Fees Penalties And Tax Rates Texas

Outstanding Texas State Tax Form Ideas Sales Exemption

Outstanding Texas State Tax Form Ideas Sales Exemption

Texas State Sales Tax Form Income Agricultural Exemption Of

If I Buy A Car In Another State Where Do I Pay Sales Tax

If I Buy A Car In Another State Where Do I Pay Sales Tax

Texas Car Sales Tax Question Mgb Gt Forum Mg

Texas Car Sales Tax Question Mgb Gt Forum Mg

Texas Sales Tax Certificate Form Income Motor Vehicle

How To Fill Out A Car Title Transfer 11 Steps With Pictures

How To Fill Out A Car Title Transfer 11 Steps With Pictures

go_auto