Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. A person who purchases a motor vehicle in texas owes motor vehicle sales tax.

Some Texas Online Sellers Receive Alarming Sales Tax Penalty

Some Texas Online Sellers Receive Alarming Sales Tax Penalty

how much is sales tax in texas for cars is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark how much is sales tax in texas for cars using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Texas car tax is going to vary because of city county and state taxes.

How much is sales tax in texas for cars. However local jurisdictions can add as much as 2 which makes the maximum sales tax rate of 825. Learn how you can calculate auto sales tax in advance so an unexpected cost wont surprise you after you close the deal. If you purchased the car in a private sale you may be taxed on the purchase price or the standard presumptive value spv of the car whichever is higher.

Look in sources and related links below to find the rate in a specific city. A texas resident a person domiciled or doing business in texas or a new texas resident who brings into texas a motor vehicle that was purchased or leased out of state owes motor vehicle use tax the new resident tax or the gift tax. Calculating sales tax summary.

However some cities and counties in texas may add additional sales tax raising the total to 825 or 825 cents per dollar. Each city has their own rates of taxation as do the counties as well. Hidden costs like auto sales tax might catch you off guard you after your purchase.

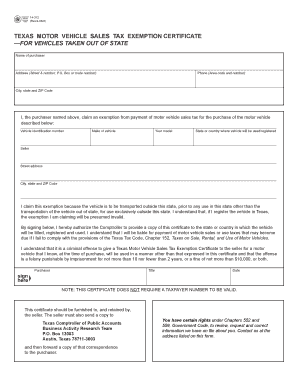

New texas residents pay a flat 9000 tax on each vehicle whether leased or owned when they establish a texas residence. The state of texas imposes a motor vehicle sales and use tax of 625 of the purchase price on new vehicles and 80 of the standard presumptive value non dealer sales of used vehicles. You can enter the city and county you live in and then will be given the rate of taxation for that location.

The texas sales tax rate is 625. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. As for sales tax in texas the rate is 625 or 625 cents per dollar.

These fees are separate from the sales tax and will likely be collected by the texas department of motor vehicles and not the texas comptroller of public accounts. How to calculate used car sales tax. A used car in texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price.

In addition to state and local sales taxes there are a number of additional taxes and fees texas car buyers may encounter. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. The best way to figure these taxes is to go to the website for taxes in texas.

Who is responsible for this tax. There is no state income tax in texas. Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

Deducting Your Sales Taxes Don T Mess With Taxes

Texas Sales And Use Tax Rates Lookup By City Zip2tax Llc

Texas Sales And Use Tax Rates Lookup By City Zip2tax Llc

How To File A Texas Sales Tax Return

How To File A Texas Sales Tax Return

Texas Sales Tax Rate Rates Calculator Avalara

Texas Used Car Sales Tax And Fees

Texas Used Car Sales Tax And Fees

Texas Collects Record 2 86 Billion In Sales Tax For July

Texas Collects Record 2 86 Billion In Sales Tax For July

Texas Sales Use Tax Permit Info Texas Trade Days

Texas Sales Use Tax Permit Info Texas Trade Days

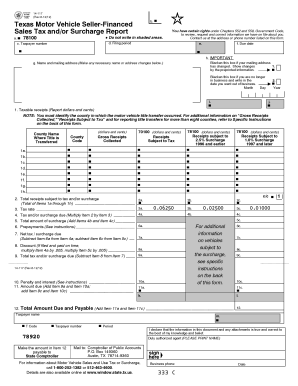

Texas Motor Vehicle Seller Financed Sales Tax Andor

Texas Motor Vehicle Seller Financed Sales Tax Andor

Texas Sets Sales Tax Records For Three Straight Months

Texas Sets Sales Tax Records For Three Straight Months

Sales Tax Finds Use On Road How Surrounding States Fund

Sales Tax Finds Use On Road How Surrounding States Fund

Population Growth Drives Texas Local Sales Tax Revenue

Population Growth Drives Texas Local Sales Tax Revenue

go_auto