The tax rate on used old car transactions has been reduced to 18 percent for large cars and suvs and 12 percent for small. What is the gst applicability on sale of company car to employee at the wrtitten down value.

Gst Relief On Old Used Car Sale Valuation Method Gst Rate Reduced Ca Divyanshu Sengar

Gst Relief On Old Used Car Sale Valuation Method Gst Rate Reduced Ca Divyanshu Sengar

sale of old car by company gst is important information accompanied by photo and HD pictures sourced from all websites in the world. Download this image for free in High-Definition resolution the choice "download button" below. If you do not find the exact resolution you are looking for, then go for a native or higher resolution.

Don't forget to bookmark sale of old car by company gst using Ctrl + D (PC) or Command + D (macos). If you are using mobile phone, you could also use menu drawer from browser. Whether it's Windows, Mac, iOs or Android, you will be able to download the images using download button.

Currently if the resale price is rs 35 lakh for a used small car the tax will be rs 7000 in a state that levies 2 per cent vat.

Sale of old car by company gst. The abolition of the cess on ambulances was positive for force motors the largest player in that segment india infoline added. Under gst tax and cess on new and old vehicles were the same28 gst plus 1 3 cess on small or compact cars and 28 gst and 15 cess on medium and bigger cars or sports utility vehicles suvs. Disposing of your assets for free.

Purchase and sale of motor vehicles. Printing company a sells its old photocopying machine to printing company b. Do i need to charge gst on the sale of my company vehicle if i am not a motor car dealer.

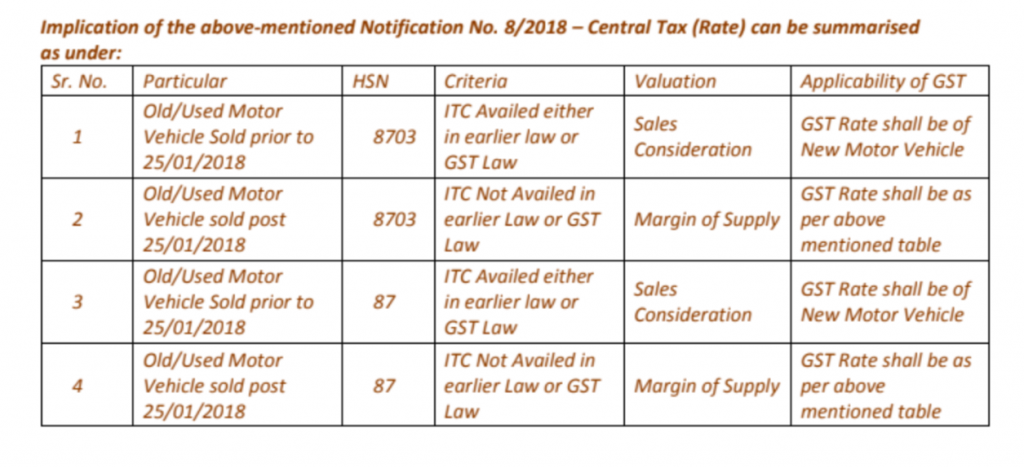

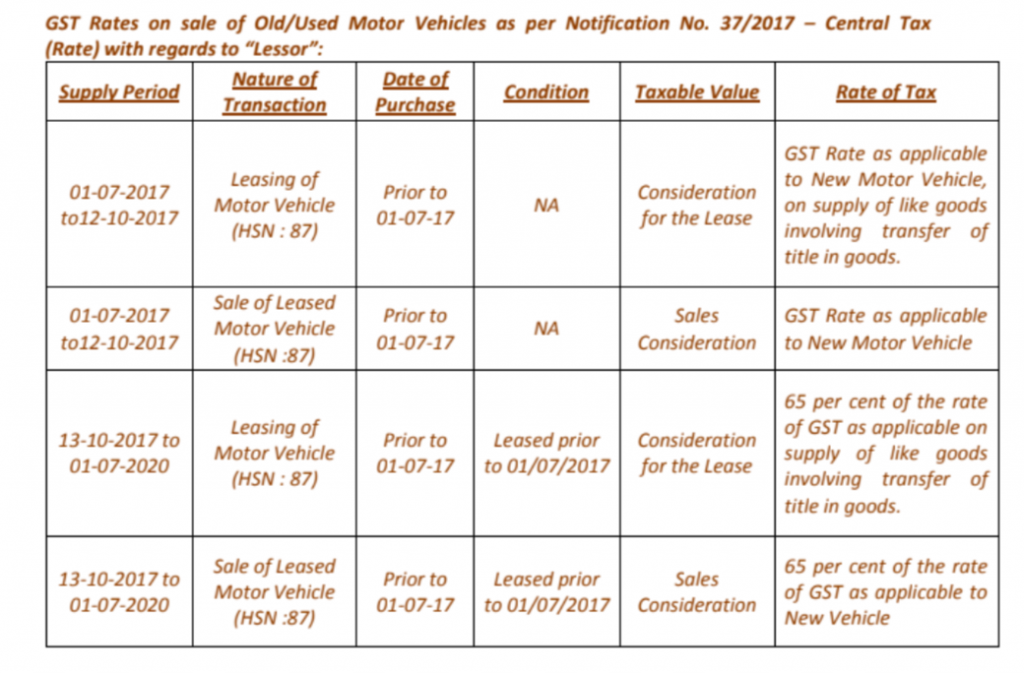

These were levied on the profit margin of the used car dealers putting sales volumes under pressure and made their business unviable. After the implementation of gst sale of used and old vehicles were taxed at the same rate as applicable on new vehicles which was 28 applicable cess which was up to 15 and due to this effective tax on sale of old vehicles was upto 43. Sale and disposal of business assets.

Yes you are required to charge gst on the sale of your company vehicle even though you did not claim gst on the purchase of the vehicle. Employee is using the car provided by company for last 2 years. Now that there is clarity of gst on used cars or old cars wherein gst is not applicable if there is no business interest in the sale of his old car or bikes potential buyers need to make note that any sales of registered used car or bike sales outlet will attract gst.

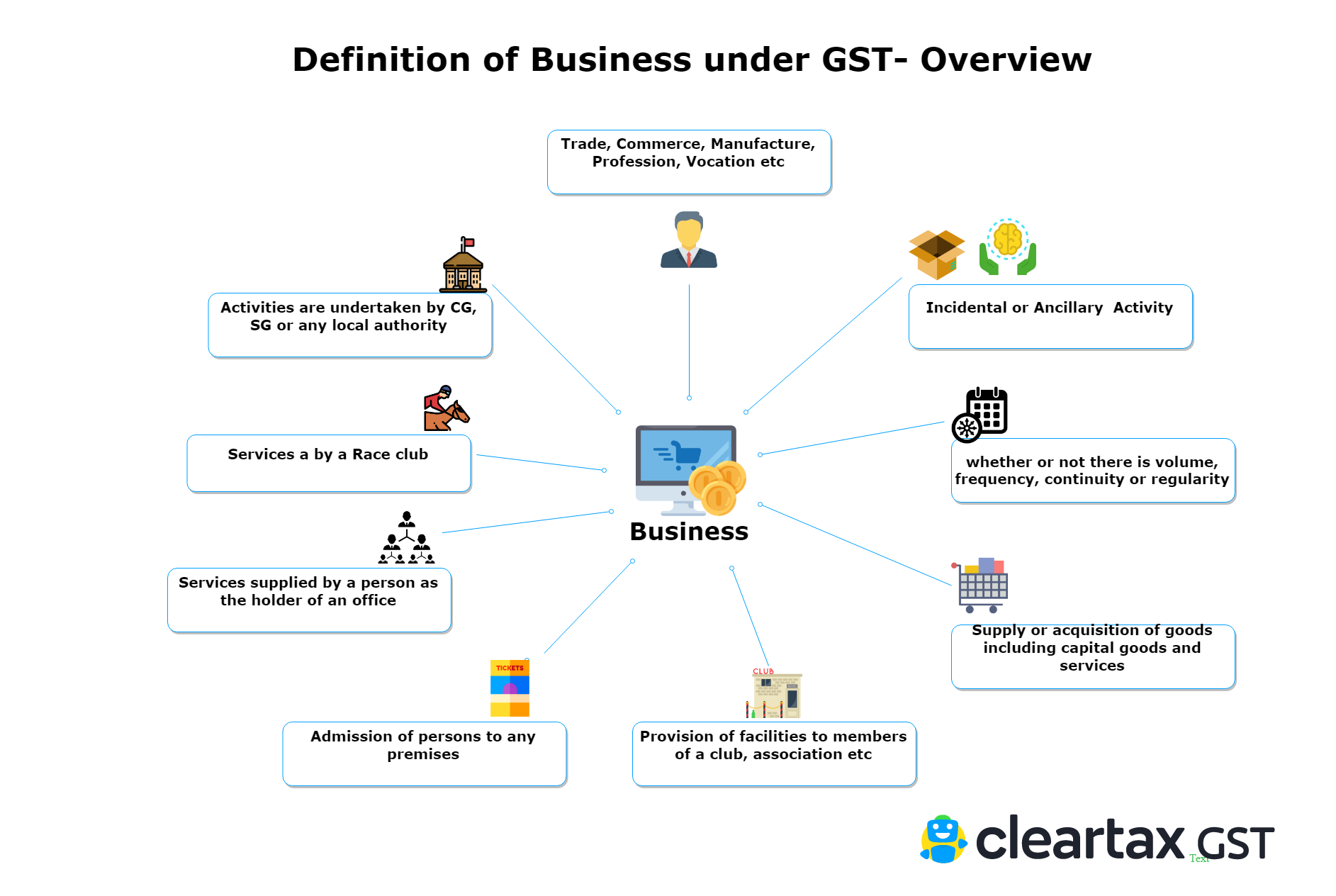

Gst is leviable on supply as defined under section 7 of the cgst act 2017 hereinafter referred as act. In order to make used cars more affordable the gst council announced a reduction in the tax rate on old used vehicle transactions in its meeting held on january 18 2017. The cost of car is deducted from employee salary.

Read more about relief for used car players as gst rate slashed for second hand vehicles on business standard. The car is depreciated in the books of the company and the employee has to buy back the car if he leaves the job within 3 years. The present moot question is whether gst is payable on sale of old and used cars by a business house.

Gst on the sale price of used cars would have amounted to double taxation as excise duty and vat are already paid and jacked up the prices. A has to charge b with gst for the machine and account for the output tax based on the selling price to b.

Gst Impact On Buying Selling Used Vehicles Taxguru

Gst Impact On Buying Selling Used Vehicles Taxguru

Gst On Sale Of Old Second Hand Cars Simple Tax India

Gst On Sale Of Old Second Hand Cars Simple Tax India

Gst No Gst On Sale Of Old Jewellery Cars By Individuals

Gst No Gst On Sale Of Old Jewellery Cars By Individuals

Applicability Of Gst On Sale Of Used Old Motor Vehicle Gst

Applicability Of Gst On Sale Of Used Old Motor Vehicle Gst

No Gst On Sale Of Old Car Used For Personal Purpose Baba Tax

No Gst On Sale Of Old Car Used For Personal Purpose Baba Tax

Gst On Sale Of Old Vehicles From 1 1 17 Till Date

Gst On Sale Of Old Vehicles From 1 1 17 Till Date

Gst On Sale Of Second Hand Goods Including Car Laptops Old

Gst On Sale Of Second Hand Goods Including Car Laptops Old

Gst On Sale Of Old Vehicles From 1 1 17 Till Date

Gst On Sale Of Old Vehicles From 1 1 17 Till Date

Gst Impact On Supply Of Used Car Taxguru

Gst Impact On Supply Of Used Car Taxguru

Gst Rate On Used Vehicles Impact Of Gst On Old Cars Sale

Gst Rate On Used Vehicles Impact Of Gst On Old Cars Sale

go_auto